Imagine a country where every extra megawatt-hour of energy from the sun or wind isn’t wasted, but stored for later—like saving light for a rainy day.

This is exactly what’s happening in Germany today, where a technical revolution is unfolding in the shadow of media debates about the green transition. More and more investors and grid operators are realizing that without large-scale energy storage, no transformation will ever be complete.

At Energeks, we’ve been tracking changes in the German market for years—because it’s Europe’s laboratory of the future. Today, we invite you on a journey through the latest investments, technological solutions, and political decisions that may soon impact your business as well.

Who is this article for—and what will you gain from reading it?

For investors who want to know where to allocate capital in the renewable energy sector.

For municipalities and local governments seeking inspiration for energy projects.

For designers and technology integrators—curious to know what others are building.

For anyone who wants to understand why energy storage is no longer the future, but the present.

Agenda:

Why Germany is building gigantic energy storage systems—policy, necessity, and strategic advantage

Which storage technologies are winning in practice—from lithium-ion to photoswitches

What does this mean for all of Europe? Case studies, numbers, and recommendations on how to profit from energy storage

Estimated reading time: 10 minutes

1. Germany: the transformation laboratory and stronghold of large-scale storage

Germany has surprised everyone again. But not with another bill or groundbreaking conference—rather, with a quiet decision whose effects are already echoing across Europe. Berlin has decided to go all in on one card: the mass deployment of large-scale energy storage systems.

And all of it—without much media noise. Quietly, consistently, and with ambition.

One might ask: why now? After all, energy storage has been discussed for years, but until recently it was seen more like a stool at the transformation table—useful, but not necessarily the first piece to be placed.

Yet the latest figures speak for themselves: Germany plans to reach 25 GW of installed energy storage capacity by 2030. That’s as if every German citizen—from Berlin to Bavaria—were gifted a personal micro-storage unit.

Except these won’t be powered by IKEA batteries, but by industrial systems capable of stabilizing entire regions of the power grid.

But it’s not just about the numbers. It’s about the mindset.

Look closer, and you’ll see that Germany isn’t building these storage systems just to “have a backup,” like an aunt keeping jars of jam in the basement.

Their strategy isn’t energy survivalism—it’s a 21st-century engineering project that merges market needs, climate policy ambitions, and hard-nosed economics.

Where did it all begin?

The trigger was the war in Ukraine and the energy earthquake it caused.

When the gas stopped flowing and energy prices soared, it stopped being “nice to have.” It became “we must have.” But instead of crawling back into the coal cave (as some countries did), Germany did something else: they began analyzing how to use every kilowatt-hour of renewable energy more wisely—not necessarily more abundantly.

Because it wasn’t just about generation anymore. It was about control over flows.

And that’s where energy storage systems entered the scene, like a superhero in the second act of a movie.

Starring: EnBW and its large-scale battery storage project in Brandenburg—one of the biggest in Europe. These systems aren’t just designed to store energy from wind farms and PV panels, but to release it at lightning speed when the grid needs it most.

Like a barista who knows when a customer walks into the café too tired to wait—they serve power almost instantly.

Technology with soul – storage as core infrastructure

It’s interesting how, for many years, energy storage was seen as a luxury feature.

A bit like heated seats in a car: nice to have, but not really essential. Today, that metaphor no longer holds. Now, storage is more like brakes in a car—without them, the entire ride ends too quickly and too painfully.

Because the more renewable energy sources we integrate, the more variability we introduce into the system.

And every “overload” or “gap” in supply must be filled with something. Storage is that intelligent buffer. A patch, a corrector, a vibration damper.

Germany—as a country with one of the most unstable power grids in Europe (due to the sheer number of distributed sources)—faces this every day. In 2023, Germany’s transmission network had to balance on the edge of blackouts more than once.

And while disaster was averted, the cost of balancing interventions reached into the billions of euros. What would a reasonable engineer do?

Invest in something that helps avoid this. Today, energy storage is the cheapest form of insurance.

Investors are saying it too: “We’re in”

And here enters another actor in this story: money.

Not subsidies. Not state funds—though they still play a role. We’re talking about private capital. More and more investment funds, industrial firms, and grid operators are discovering that investing in storage pays off. On the surface, it may look like a big battery—but in reality, it’s a financial arbitrage engine. Buy low, sell high. In seconds. Even 4–6 times a day.

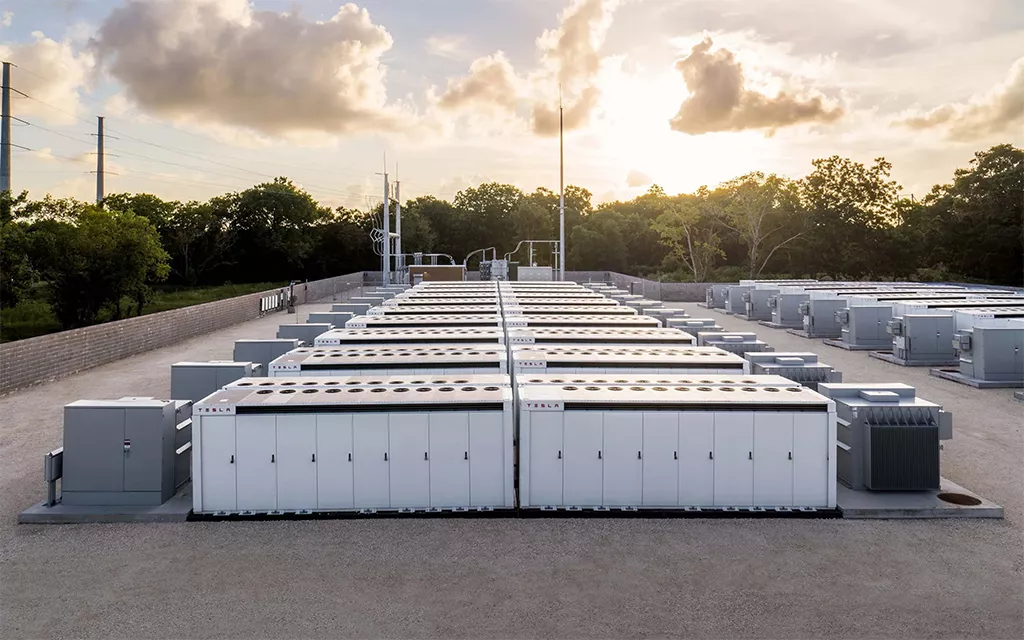

Take Tesla’s Megapack systems installed in Germany, for example.

They’re generating real revenue by participating in what’s called Frequency Containment Reserve (FCR). Every sudden dip in the grid becomes a profit opportunity.

And investors are rubbing their hands—because the rate of return on such projects can beat that of many solar farms.

Interestingly, this is exactly what’s drawing in smaller players too—local utilities, municipalities, even energy cooperatives. Instead of just producing energy, they’re learning to manage it optimally. And that’s a game-changer.

Is Germany an exception?

Surprisingly—not at all. They just started earlier.

While others debated the costs of the green transition, Germany was calculating... how much the lack of one would cost. Today, their advantage doesn’t lie in having better technologies, but in knowing how to implement them faster.

And with broad public support. Where there once was resistance to “giant batteries,” there’s now pride. And sometimes even prestige—a municipality with its own storage system is like a town with its own brewery. Only instead of beer, it serves power when others go dark.

2. From lithium-ion to photoswitches: which technologies will dominate the market?

Let’s ask ourselves: is a battery just a box of electricity?

Something you charge and discharge, like your phone after a day of scrolling? Nothing could be further from the truth. In the world of industrial energy, a storage system is more like a wine cellar: it’s not just about “how much,” but “how long,” “how fast,” “at what temperature,” and “whether it can turn a profit.”

That’s exactly why Germany, in building its new energy ecosystem, hasn’t put all its eggs in one basket. Several technologies are being developed in parallel and tested under various conditions—like a chef pairing ingredients with the season, the guests’ appetite, and the restaurant’s budget.

Below, we explore which technologies are currently winning in practice, which are gaining traction, and which—though they may sound futuristic—are already being implemented in real-world settings.

Lithium-ion: seasoned veterans with new energy

Let’s start with the classic. Lithium-ion batteries aren’t just found in our laptops and electric cars.

They are also the backbone of today’s industrial-scale energy storage. No surprise there—their energy density is high, efficiency exceeds 90%, and their reaction time is measured in milliseconds.

For the power grid, it’s like having a friend on speed dial—one signal, and they’re there to help.

In Germany, lithium-ion technologies are currently dominant. Companies like EnBW, RWE, and many local operators are betting on them. NMC (nickel-manganese-cobalt) chemistries provide high power and are ideal for grid-balancing services. Meanwhile, LFP (lithium iron phosphate) offers better thermal stability and a longer lifespan—making it increasingly popular for applications that demand frequent cycling.

But a word of caution: lithium-ion isn’t a one-size-fits-all solution. Their production depends on critical metals, and storing large amounts of energy in small spaces raises safety questions. That’s why alternatives are gaining ground alongside them.

Flow batteries: a technology for the patient

At first glance, they look like something from a beverage factory.

Large tanks filled with colorful liquids, pumps, pipes, valves. But inside—pure engineering magic. Flow batteries don’t store energy in a “closed” electrolyte inside a cell; instead, they store it in separate tanks, which can be scaled up with ease.

Their big advantage?

Power and capacity are decoupled. Want more energy? Add a larger tank. Need faster charge and discharge? Invest in a more powerful cell module. It’s like cooking—you can use a 5-liter pot or a 50-liter one, but it’s the same water inside.

Germany is testing this technology mainly in off-grid setups and industrial-scale solar farms.

The greatest strength of flow batteries is their long lifespan—up to 20 years and 10,000 cycles without degrading performance. This makes them a compelling option wherever stability matters more than power output.

Their downside? Cost. Producing electrolytes (such as vanadium-based ones) is expensive, and the infrastructure is complex, requiring both space and technical expertise.

They’re not mainstream yet—but judging by the pace of development, it’s only a matter of time.

Thermal storage: back to the roots

Before anyone invented lithium cells, people stored energy in... water and rocks.

And while it may sound medieval, thermal technologies are making a comeback. Thermal storage systems—especially those using phase-change materials (PCM) or hot sand—are now being tested in Germany for district heating and industrial applications.

Their edge is cost. They don’t require rare earth metals. They don’t need ultra-clean environments.

And they don’t explode. Instead, they store energy as heat, which can later be recovered for industrial processes or even converted back into electricity. Maybe not a Tesla Model S, but definitely a Volkswagen Transporter—reliable, simple, and tough as nails.

One especially interesting project is being developed by Kraftblock, which is building a thermal storage facility in Saarland that can operate at over 1000°C.

While it currently supports energy-intensive industry, it could one day become part of urban heating systems powered by renewables.

Photoswitches: science fiction that works

And finally, the crème de la crème—photoswitches.

Sounds like something Tony Stark would install in the Iron Man suit. But this technology is real—and it’s now being tested as a method of long-term solar energy storage.

In short: photoswitches are chemical compounds that change their molecular structure under light exposure, storing energy in the form of chemical bonds. This energy can then be released—as heat, for example—exactly when needed. No losses. No moving parts. No cables.

A research team at the University of Jena in Germany has developed a stable photoswitch that lasts for months without degradation. This means energy from summer sunshine could be stored and used in the dead of winter. Like a thermos that keeps tea hot not for hours—but for weeks.

Though still in early stages, this technology holds massive potential—especially in passive construction, heating systems, and autonomous microgrids.

Even more exciting: if a scalable system can be created, photoswitches could revolutionize how we store thermal energy—without converting it back into electricity.

How do you choose the right technology for your project?

There’s no single answer. It all depends on your consumption profile, location, grid availability, regulation—and... the investor’s vision. A storage system for a PV farm? Lithium-ion.

One for a steel mill? Thermal. A long-lasting buffer for an off-grid housing community? Flow. A heating solution for a passive house? Maybe a photoswitch.

It’s a bit like clothes—you wouldn’t wear a suit to the beach or swim trunks to a board meeting. Energy storage must be “tailored to fit”—and that’s exactly what German technology firms are doing today.

R&D trends: what’s coming by 2030?

Labs are bursting with new ideas.

Sodium-ion batteries, gravity-based storage, compressed air systems (CAES), hybrids combining different cell types—it’s all being tested already. But one thing is certain: the user will remain at the center. Because any technology that doesn’t deliver end value (stability, savings, convenience) has no future.

That’s what we’re seeing in Germany—a country not following a single path, but building a smart mix.

We are ready to support that diversity—providing infrastructure, know-how, and people who believe that good energy starts with good decisions.

3. Where is Europe’s energy goldmine? How energy storage is becoming a profit engine and a system safety anchor

In the world of energy transformation, the winner is the one who can think several moves ahead.

And Europe—though not always united—is slowly beginning to speak a common language: flexibility, stability, scalability. While these terms may sound like something out of an automation manual, they all come down to a simple truth: energy storage is no longer optional.

It’s a necessity—and... an opportunity for profit.

A decade ago, no one predicted that storage capacity would be measured in tens of gigawatts.

Today, the European Commission estimates that by 2030, installed energy storage systems in the EU will exceed 200 GW—and could reach 600 GW by 2050.

That’s as if every EU country gained a new virtual power plant—no smokestacks, no noise, and the ability to operate 24/7. And while the technology, regulations, and business models are still evolving, one thing is already clear: those who invest first will benefit most.

A new energy landscape—who’s designing it?

For decades, Europe’s energy system was based on large, centralized units—coal, gas, nuclear.

It’s like building a city with one massive kitchen, from which meals must be delivered to every neighborhood. But when solar panels, wind turbines, and micro-sources began popping up everywhere, kitchens started appearing all over.

Great! But how do you synchronize that culinary chaos?

The answer: energy storage as local buffers and intelligent power dispatchers.

With storage, you can retain surpluses, delay consumption, smooth fluctuations, and even earn from price differences—known as energy arbitrage. And that last function is generating growing excitement among investors.

Because while storage doesn’t produce energy, it can... monetize it at the perfect moment.

The UK example: earning before the competition wakes up

The United Kingdom is a European pioneer of “batteries as business.”

Today, the UK operates over 2.5 GW of battery energy storage systems, and this number is expected to grow to 24 GW by 2030. The government has created favorable conditions: an auction system, strong demand for balancing services, clear regulations, and competitive markets.

The result? A new sector of the economy has emerged—where batteries are as profitable as wind farms.

UK-based storage systems earn not only through arbitrage but primarily by providing system services: frequency regulation, reserve power, and grid relief.

And they do it faster than any conventional power plant.

Example? It takes just a millisecond to respond to voltage changes—making them invaluable partners for grid operators.

Return on investment? According to Aurora Energy Research, with the right operating model, energy storage systems can pay off in 4–6 years.

And the more unstable the grid (read: more renewables), the faster the return.

Germany and Scandinavia: growing ambitions

In Germany, a market is forming that combines energy storage with the capacity market and system services.

Transmission system operators such as TenneT and TransnetBW have already contracted large-scale storage projects with capacities ranging from 100 to 250 MW. These systems operate like “intelligent fuses”—delivering energy instantly when there’s a risk of blackout.

The same is happening in Scandinavia—Norway and Sweden have opened their markets to flexibility services provided by storage, hydro plants, and even electrolyzers.

This approach means that any energy asset can become a revenue-generating resource—as long as it can respond dynamically.

Poland: not a leader yet, but at the starting line

In Poland, it’s still early days—but with a clear signal: something has shifted.

By 2025, the PSE registry already includes over 50 energy storage projects. As of September 2024, systems with a total capacity of 1.9 GW had already been connected. These are no longer pilots. They are real systems—built to operate, generate revenue, and ensure security.

Currently, the biggest financial lever is the capacity market.

17-year contracts provide predictability and make financing possible (from the EBRD, project finance funds, and banks).

In 2024, five storage projects secured such contracts for 165 MW, and for this year’s prequalification round... as much as 16 GW was submitted. This shows that investors believe in the market—what’s needed now are regulations that allow storage not just to “survive,” but to grow.

Flexibility services: a new chapter of revenue

Across Europe, the importance of flexibility services is growing as the foundation of modern energy systems.

It’s a response to the dynamic challenges of grids built on renewables—full of variability, peaks, and dips in demand. To meet these needs, EU regulations increasingly support the development of a market where active consumers, storage systems, aggregators, and local producers are full-fledged market participants.

What does this mean in practice? With the opening of the flexibility market:

you can earn by adjusting consumption or generation profiles—e.g., delaying energy use or offering surplus to the grid

grid operators are obliged to identify and communicate flexibility needs

auction platforms and local markets are emerging where anyone can “list” their flexibility—like a marketplace of instant reactions

It’s a new chapter for investors: those who respond fastest and most accurately to system needs win the most.

In this context, a well-designed energy storage system becomes not just a technical buffer, but a profitable financial asset—capable of generating revenue across multiple streams: capacity markets, energy markets, system services, and flexibility services.

This is not a future scenario—it’s already unfolding. And energy storage is its most finely tuned instrument.

How to truly profit from storage

Simply selling energy is no longer enough.

The wholesale market is volatile, and price arbitrage alone has its limits. But combining multiple revenue streams—that’s a completely different conversation. Investors should think like hotel owners: besides rooms (energy), they offer breakfasts (system services), conference halls (flexibility services), and VIP packages (capacity contracts).

Experts at the Energy Storage Summit point out that today, storage earns the most where the market is open and competitive—such as in the United Kingdom or Ireland.

Let’s build a system that works—flexibly, cleanly, and profitably

Europe is moving toward a system where the winner isn’t the biggest player—but the one who can collaborate most effectively, anticipate needs, and respond to change.

Energy storage is no longer just a technology—it’s a symbol of intelligent strategy and conscious thinking about the future. Today, we are laying the foundation for a flexibility market. Tomorrow, it will set the rhythm for energy balance.

At Energeks, we take pride in being part of this transformation.

As a leading supplier of medium-voltage transformers and transformer stations in Europe, we don’t just deliver technology—we design solutions that matter. Our work goes far beyond daily deliveries. For years, we’ve stood beside our clients as partners who listen, understand, and deliver exactly what’s needed.

That’s why our offer keeps evolving.

Alongside our flagship transformer solutions, you’ll find modern EV charging stations, inverters, energy storage systems, and high-performance power generators. We support e-mobility, design for sustainability, and actively contribute to the growth of renewables—especially by delivering smart solutions for solar farms.

Our technologies enable efficient collection, processing, and distribution of solar energy—tailored to the market’s real challenges.

But what truly drives us is people—our clients, collaborators, and partners.

Because Energeks isn’t just about products. It’s a story of shared knowledge, the search for better ways, and the creation of solutions that truly make a difference. Together, we’re building a world where clean and renewable energy is no longer a vision—it’s the standard.

We invite you to collaborate—get to know us, be inspired by our values.

If you’d like to talk about your project, contact us. We’d be happy to respond, share our experience, and help you find the solution that will deliver energy... exactly where you need it.

And if you want to stay up to date with what inspires us, drives us, and moves us forward—join our community on LinkedIn. Let’s create impact together for a better future for all of us.

Sources:

Cover Photo: Tesla Megapack

Reviews

No reviews!